$How To Save Money$

What you can do right now.

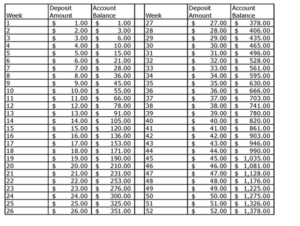

What can you do today? As in right now? Probably the real reason why you’re here, right? What I’ve learned during my own financial journey is that saving money has to become a habit. So, to get you into a habit, I want you to first click on the photo below. Then blow it up full screen on your phone and screen shot the picture.

Got it? Okay, good. Now save it to your phone’s wallpaper. Why, you ask? So that you’ll see it everyday. Don’t trust your memory. Save this to your phone’s front screen so that you’ll be reminded to put that amount into your savings for that week. Yes, the adorable phone wallpaper of your kids will have to go for a while, but that’s okay. You’re doing this for them.

This will get you into the habit of putting money away. Get that muscle to start building. When you work out, you don’t go right to the heavy stuff. You have to slowly build your way up. A giant oak tree starts inside a tiny acorn.

Once my wife and I get to $30.00, we finish out the year just putting that amount each into the envelope from week 31 to 52. And we still end up with $2,190 at the end of the year! If you’re doing this by yourself, you’ll end up with $1,095 at the end of the year. If you decide to stop at $30.00, that is.

If you’re unable to go all the way to $52.00, or even finish out the year at $30.00, that’s okay! Continue with an amount that makes you feel comfortable. The point of the exercise is to get you into the habit of putting money away. And anything is better than nothing! I’ve seen some people just put $20.00 a week away for 52 weeks. That’s $1,040 you’ll have at the end of the year! $2,080 if you do it with a spouse!

Okay, now that you’re building your empire, what’s the second thing that you can do? Tomorrow, go to your bank and say, ” I want to open a money market account.” A money market account is just like a savings account. The only difference is that a money market account earns more interest every month. More interest than your regular savings account does. Yea, that’s right. Banks don’t tell you that because they don’t want to pay you more.

Don’t worry, your money will be just as liquid as it was in your regular savings account. There’s no penalty’s for withdrawing money from a money market account. Back before everything went haywire in 2008, my money market account was earning $20.00 a month. That’s $20.00 for doing nothing! Totally passive income. And I had around $10,000 in there. If it was just a regular savings account, it would’ve only earned around $2.00 to $4.00 a month. So, open a money market account as soon as possible and put the money that you’re saving into it so that it can grow at a higher interest rate.

Once you have a nice nest egg, then you can invest in things like real estate or mutual and index funds that will earn even more interest! Just be sure to seek advice from a professional. Advice from a broke family member who never had a lot of money is not wise. And always invest what you can afford to lose and never invest in what you don’t understand. A professional can break it down for you into simple terms. If someone can’t explain it so that you can understand what you’re putting your money into, then run Forest, run!

Okay, I don’t want to overwhelm you so this will be the last thing that you can do. Right now. As in today. And that is start reading. You’ve got to read! What I’m telling you now is just the tip of the iceberg. You’re going to learn so many tricks about building wealth by just reading.

There’s a myth in our society today that states that, “only the rich get the tax breaks.” And, “only the rich know the tricks.” Horse fart! Us working folks get the same breaks. It’s just that 90% of you are too busy to pick up a freaking book and learn them! You’d rather watch other people’s dream come true on t.v. or goof off on facebook. Have you ever noticed that the million dollar homes on t.v. have built in libraries? Hmmmmm.

What books, you ask? My top 5 books are right here on this LINK .

I hope I didn’t sound too harsh. But I know how hard you work out there and I want you to have something to show for it. All those nights when you came home and your buttcrack was chapped from walking all day. All those cuts on your fingers and hands. Don’t you want something to show for it? “Yea, but Lex, you can’t take it with you.” Pa-leese, I’m so sick and tired of that cliche mantra. That’s right, you can’t take it with you. But, you can leave it for a loved one to enjoy. A child. A grandchild even! Wouldn’t you like to have that legacy? A legacy that you built so that a future generation can enjoy a better life. And if you have debt that you need to pay off first, then read The Total Money Makeover and you’ll learn step by step how to get out of debt.

My friends the time is now. It’s time to sacrifice a few years of your short term pleasure, long term pain lifestyle for decades of freedom. Whether it be partying, cigarettes, Starbucks, or alcohol. You can suffer the pain of discipline or you can suffer the pain of regret. Those are your two choices. The only way things will get better for you, is when you get better.

Related Topics:

How I Started My Financial Journey- LINK

Top 5 books about money.

Be sure to stay tuned to my blog for more money talk and side hustles.

Disclaimer: Lex Vance the creator of Dirty Maintenance Nation is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com.

This page contains affiliate links, which means that if you click on the link and make a purchase, I’ll receive a small commission. Thank you so much for supporting dirty maintenance nation!